How to Compare Stocks (Without Losing Your Mind)

Ever found yourself staring at a bunch of stock charts, completely stuck, thinking, “I don’t know which one to pick—I love them all!”

Don’t worry, you’re not alone.

Choosing between multiple great-looking stocks can be a total headache, especially in booming industries where everyone seems to be a winner.

But here’s the good news: You don’t need a Master’s in finance or a crystal ball to compare stocks effectively. You just need a solid process—and that’s exactly what I’m going to give you.

Think of it like assembling your dream sports team: Every player (or stock) has a role to play, and balance is key.

So, let’s dive into a six-step method to help you cut through the noise and pick the best stocks with confidence.

Step 1: Can You Explain the Business to a 12-Year-Old?

If you can’t explain how a company makes money in simple terms, you probably shouldn’t invest in it. Period.

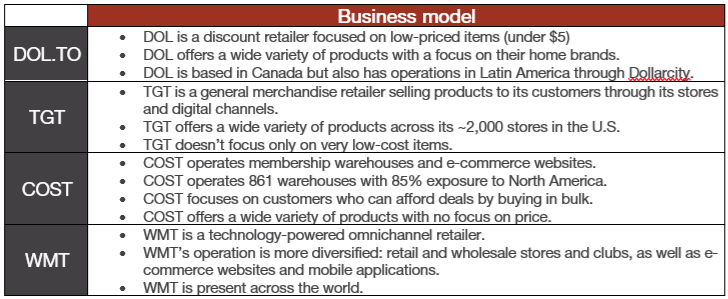

A great way to do this is by looking at real-world examples. Let’s compare four major discount retailers:

- Dollarama (DOL.TO) – Cheap products, mostly under $5, stronghold in Canada, growing in Latin America.

- Target (TGT) – General merchandise stores across the U.S., solid e-commerce, competes with Amazon and Walmart.

- Costco (COST) – Warehouse club model; you pay a membership fee to access bulk deals.

- Walmart (WMT) – Massive global retailer, strong in e-commerce, also owns Sam’s Club.

Right away, you can see that even though they’re all in the same industry, they play different games. Do you want the budget-friendly underdog (Dollarama), the bulk-buying giant (Costco), or the all-in-one retailer (Walmart)?

This step alone can help you eliminate stocks that don’t align with your investment goals.

See how I do it in the video below.

Step 2: The Dividend Triangle – Your Financial Cheat Code

Imagine you’re buying a house. You wouldn’t just look at the price—you’d check the neighborhood (revenue growth), structural integrity (earnings growth), and whether the foundation is crumbling (dividend growth).

That’s exactly what the dividend triangle does for stocks. It evaluates:

Revenue Growth – Is the company making more money over time?

Revenue Growth – Is the company making more money over time? Earnings Growth – Is it actually profitable?

Earnings Growth – Is it actually profitable? Dividend Growth – Are they paying and increasing dividends consistently?

Dividend Growth – Are they paying and increasing dividends consistently?

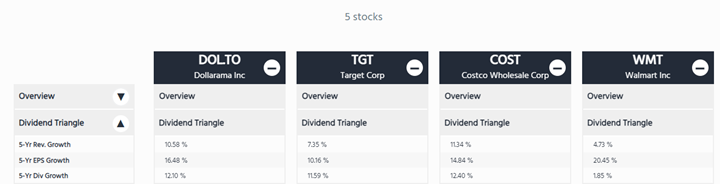

Let’s compare our retailers:

- Dollarama & Costco: Strong revenue, earnings, and dividend growth. These are the “A+ students” in this comparison.

- Target & Walmart: Decent numbers, but weaker growth—Walmart’s 1.85% dividend growth over five years is… not great.

If you’re a dividend growth investor, Dollarama and Costco are already pulling ahead.

The ONLY List Using the Dividend Triangle

As you can imagine by now,  I analyze companies according to their dividend triangle (revenue, earnings, and dividend growth trends), combined with their business model and growth vectors. While this may seem too simple, two decades of investing have shown me it is reliable.

I analyze companies according to their dividend triangle (revenue, earnings, and dividend growth trends), combined with their business model and growth vectors. While this may seem too simple, two decades of investing have shown me it is reliable.

While many seasoned investors also use these metrics in their analysis, no one has created a list based on them before. This is exactly why I created The Dividend Rock Stars List.

The Rock Stars List isn’t just about yield—it’s built using a multi-step screening process to ensure the highest-quality dividend stocks. You can enter your name and email below to get the instant download in your mailbox.

Step 3: Where’s the Future Growth?

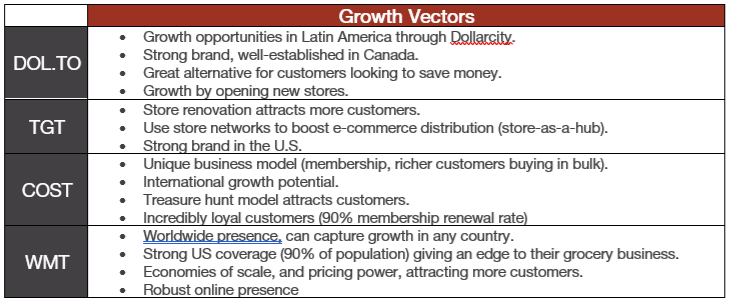

Okay, so we’ve looked at the past—now let’s talk about the future. A stock that’s doing well today needs growth catalysts to keep going strong.

Questions to ask: Are they expanding into new markets?

Are they expanding into new markets? Do they have game-changing innovations?

Do they have game-changing innovations? Is their industry on an upward trend?

Is their industry on an upward trend?

Real Example: Costco’s expansion into Asia and Europe? That’s a massive growth opportunity. On the other hand, Target’s revenue has plateaued.

Real Example: Costco’s expansion into Asia and Europe? That’s a massive growth opportunity. On the other hand, Target’s revenue has plateaued.

Which one would you rather own for the next 10 years?

Step 4: What Could Go Wrong? (A.K.A. Risk Management 101)

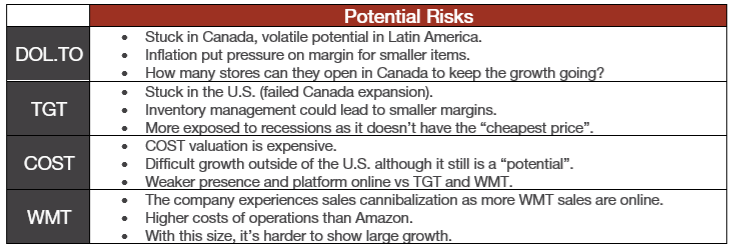

Nobody likes talking about risks, but they can make or break your investment. It’s not about being paranoid—it’s about being prepared.

Common red flags:

Common red flags:

- Sky-high debt – If interest payments eat up profits, dividends could be at risk.

- Industry disruption – If a company isn’t innovating, it could get left behind.

- Macroeconomic risks – Inflation, interest rates, recessions—some industries handle these better than others.

Example: Walmart faces brutal competition from Amazon. Dollarama, on the other hand, is pretty safe from e-commerce because, let’s be honest, nobody’s ordering $2 tape measures online.

Step 5: Dividend Safety – Will You Actually Get Paid?

A high dividend yield is worthless if the company can’t sustain it. (Looking at you, companies that cut dividends just when investors need them most!)

Key checks:

Key checks:

- Payout Ratio – A lower ratio (<70%) means more room for dividend growth.

- Dividend History – Long-term increases = reliability.

- Free Cash Flow (FCF) – Healthy cash flow = safe dividends.

Comparison:

Comparison:

- Dollarama and Costco: Rock-solid dividend safety.

- Walmart: Meh. Dividend growth is weak, payout ratio is getting tight.

If you’re building a passive income stream, you want reliable dividend growers, not companies barely scraping by.

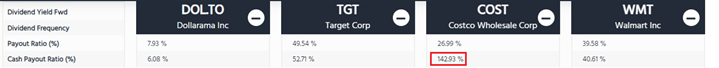

In this example, you will notice all payout ratios are under control but one: COST cash payout ratio:

After digging a little bit, you will realize it was related to its recent special dividend payment. COST payout ratio goes crazy each time it issues a special dividend.

Step 6: Is It a Good Deal? (Valuation 101)

Even the best stock is a bad investment if you overpay for it. But here’s the catch: Valuation is more art than science.

Ways to check if a stock is overpriced:

Ways to check if a stock is overpriced:

- P/E Ratio (Price-to-Earnings) – Is it reasonable compared to industry peers?

- Dividend Discount Model (DDM) – Estimates stock value based on future dividends.

- Historical Dividend Yield – If a stock’s yield is much higher than usual, it could be undervalued.

Tip: A “cheap” stock isn’t always a good buy (cough IBM in 2015 cough), and an “expensive” stock isn’t always a bad buy (cough Amazon in 2010 cough). Context matters!

Tip: A “cheap” stock isn’t always a good buy (cough IBM in 2015 cough), and an “expensive” stock isn’t always a bad buy (cough Amazon in 2010 cough). Context matters!

Final Verdict: Who’s the Winner?

Now that we’ve crunched the numbers and compared everything side by side, here’s the final score:

Top Picks:

Top Picks: Dollarama & Costco – Strong revenue, earnings, and dividend growth with clear expansion potential.

Dollarama & Costco – Strong revenue, earnings, and dividend growth with clear expansion potential.

Weaker Choices:

Weaker Choices: Target & Walmart – Slower growth, lower dividend increases, and more competition.

Target & Walmart – Slower growth, lower dividend increases, and more competition.

If you want a dividend growth beast with strong fundamentals, Costco or Dollarama are your best bets. If you prefer defensive, lower-growth stocks, Walmart might work for you—but don’t expect massive returns.

Investing Is a Marathon, Not a Sprint

The stock market can be overwhelming, but following a structured process makes it 10x easier to make smart decisions. Here’s your game plan:

Understand the business model – Can you explain it simply?

Understand the business model – Can you explain it simply? Check the dividend triangle – Strong revenue, earnings, and dividend growth?

Check the dividend triangle – Strong revenue, earnings, and dividend growth? Look at future growth drivers – Is the company expanding?

Look at future growth drivers – Is the company expanding? Identify risks – What could go wrong?

Identify risks – What could go wrong? Check dividend safety – Will they keep paying you?

Check dividend safety – Will they keep paying you? Assess valuation – Are you paying a fair price?

Assess valuation – Are you paying a fair price?

If you follow these steps, you’ll never feel lost when comparing stocks again. Now go out there and start selecting your favorites from the Dividend Rock Star list!

Enter your name and email below!

The post How to Compare Stocks (Without Losing Your Mind) appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/how-to-compare-stocks/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.