This Trump Shock Is A Reverse Nixon

By Michael Every of Rabobank

Hoot Small-ly and Reverse Nixon Again

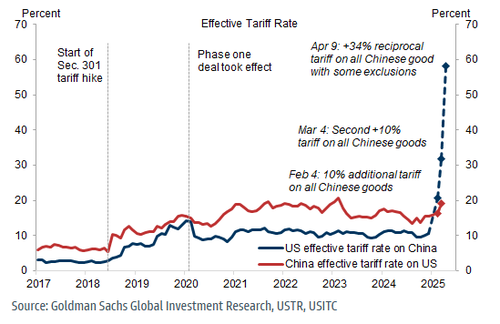

In line with the Churchillian tone I had struck, yesterday’s US tariffs were historic and suggest a world-wide battle. It remains to be seen in what form, with what outcome, but global bifurcation is again on the cards. The US raised its weighted-average tariff to 29%, the highest in over 100 years, and above the Smoot-Hawley tariffs of the 1930s. That’s staggering, not just for the US, or inflation or GDP, but for the global system built on the US as consumer of last resort for everyone else’s overproduction and the US dollar as the lubricant for that trade and the US financial assets everyone accumulates as a result.

The US assumed a non-tariff barrier with each trade partner leading to reciprocal tariffs as the simple function of the US bilateral trade deficit as a ratio of exports to it, e.g., Indonesia runs a $17.9bn trade surplus with the US and exports $28bn to it, so $17.9/$28 = the 64% assumed Indonesian trade barrier, which the US offered a ‘discount’ on down to 32%. On one hand, this is nonsense. On the other, it’s exactly what Ricardian theory says should happen under free trade: all bilateral flows should balance, with the composition of the basket shifting with comparative advantage. That it never does for the US shows the theory isn’t true; so, the US is using both hands to pull down the system ostensibly based on it. It’s critical to understand that before talking about the numbers below and hooting small-ly about Smoot-Hawley.

We got massive increases in tariffs on Asian exporters like Bangladesh (37%), Cambodia (49%), China (34%), India (26%), Indonesia (32%), Japan (24%), South Korea (25%), Thailand (36%), and Vietnam (46%). Moreover, these are stackable on top of pre-exiting tariffs, so China faces 54% at least, with the threat of another 25% for buying Venezuelan oil and another 25-50% for buying Russian oil. That is a dramatic escalation between the world’s two largest economies.

The EU fared slightly better (20%), but which is four times higher than what we had presumed in our own model assumptions.

Most others, including the UK, Australia, and New Zealand got 10%, a divide-and-rule tactic we’d expected, as did Latin America, the Monroe Doctrine also expected, especially if the US now offers dollar liquidity to help shift supply chains in that direction. But what then for Brazilian agri trade to China?

Nobody –except Russia(but that’s because it is under sanctions)– was overlooked: even a small island off Australia got a 10% tariff for its population of penguins, and the closest of US defence allies like Israel and the Philippines face 17%, while Iran only sees 10%. The only exemptions apart from Canada and Mexico were on steel and aluminium, autos, copper, pharmaceuticals, semiconductors, bullion, energy and other minerals not available in the US; but the first three already have 25% tariffs in place, with the rest waiting for one.

The US postal de minimis loophole is also over for everyone with a tariff once systems are ready, except for bonafide gifts and items brought into the US while traveling. That upends a lot of e-commerce.

We now start the next phase of negotiation and/or retaliation. It’s hard to imagine the UK, Australia, or New Zealand will rock the boat, and the same is true for anyone getting just a 10% tariff. Indeed, Latin America may be rubbing its hands at the geostrategic windfall ahead.

But what about Asia? For example, will China allow CNY to move lower? Does that drag other FX down with it? Does the US then raise tariffs even higher? Or will China switch to domestic consumption, which would be inflationary? What are the options for Japan, South Korea, Vietnam, Cambodia, Thailand, and India? They can’t “trade more with China” unless it plays the US importer/consumer role, but it won’t want to import more. So, does all of Asia inflate domestically with the US, or sink into deflation? Or does everyone but China pivot to the US side vs. China?

Will Liberation Day transform the world? The Nixon Shock set a radical precedent’) thus:

“My philosophy, Mr President, is that all foreigners are out to screw us and it’s our job to screw them first.” With these words, the US Treasury Secretary convinced the President to deliver a colossal shock to the global economy. In the words of one of the President’s men, the objective was to trigger “a controlled disintegration of the world economy”.

No, those words were not spoken by members of President Trump’s team in advance of their “Liberation Day” tariff splurge. While the “foreigners are out to screw us” certainly has a Trumpian ring, it was uttered in the summer of 1971 by then Treasury Secretary John Connally, who succeeded in convincing his President to unleash the infamous Nixon Shock a couple of days later.

Commentators should know better than to pretend that the shock Trump is now delivering is both “unprecedented” and bound to fail like all “reckless” assaults on the prevailing order. The Nixon Shock was more devastating than the one delivered today, especially for Europeans. And precisely because of the economic devastation caused, its architects achieved their main long-term objective: to ensure American hegemony grew alongside America’s twin (trade and government budget) deficits.

The success of the Nixon Shock in no way guarantees the success of Trump’s version, but it does remind us that what is good for America’s rulers is not necessarily good for most Americans or, indeed, for the world.

One of the smartest Nixon advisers, who helped to convince Connally of the need for a shock, articulated this point with brilliant clarity: “It is tempting to look at the market as an impartial arbiter. But balancing the requirements of a stable international system against the desirability of retaining freedom of action for national policy, a number of countries, including the US, opted for the latter.”

Then with one additional phrase he undermined all of the assumptions on which Western Europe and Japan had erected their post-war economic miracles: “A controlled disintegration in the world economy is a legitimate objective for the Eighties.”

And 10 months after giving this lecture, the man in question, Paul Volcker, rose to the Presidency of the Federal Reserve. Soon, US interest rates were doubled, then trebled. The controlled disintegration of the world economy, which had started when President Nixon was convinced by Connally and Volcker to dismantle the hitherto stable exchange rates regime, was now being completed with interest rate hikes that were far more devastating than Trump’s tariffs can ever be today.

Trump is therefore not the first President to seek the controlled disintegration of the world economy by means of a devastating blow. Nor is he the first to purposely damage America’s allies to renew and prolong US hegemony. Nor the first who was prepared to hurt Wall Street in the short run in the process of strengthening US capital accumulation in the long term. Nixon had done all that half a century earlier. And the irony is that the world the Western liberal establishment is grieving over today came into being as a result of the Nixon Shock.”

He concludes: “Every generation likes to think it is on a cusp of some historic transformation. But ours is cursed enough to actually be on such a cusp. So rather than focusing too much on the character of the man in the White House, we would do well to recall that the Nixon Shock was much more important than Nixon. If Nixon reshaped the world once, leaving it nastier and more unbalanced, Trump can certainly do it again.”

This Trump Shock is, again, a reverse Nixon: to take the US from trade deficits and financialisation back to raw US mercantilist power, using parts of the old system to do so. (As I have put it, using economic statecraft; or, using financial Fartcraft to shift back to Warcraft.)

That’s as: the US put sanctions on some Russian entities; Israel blew up the runway of the Syrian airbase Turkey is taking over; the US pours military equipment into the Middle East; the US senate pencils in $5 trillion in tax cuts over the next decade; and Elon Musk is rumored to be leaving the White House circle soon –stocks rallied (“No more DOGE corruption-cutting!”)– which he denied.

Tyler Durden Thu, 04/03/2025 – 13:45

Source: https://freedombunker.com/2025/04/03/this-trump-shock-is-a-reverse-nixon/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.